Webhuk ERP

Multi-Jurisdiction Taxes

Multi-Jurisdictional Tax Modules

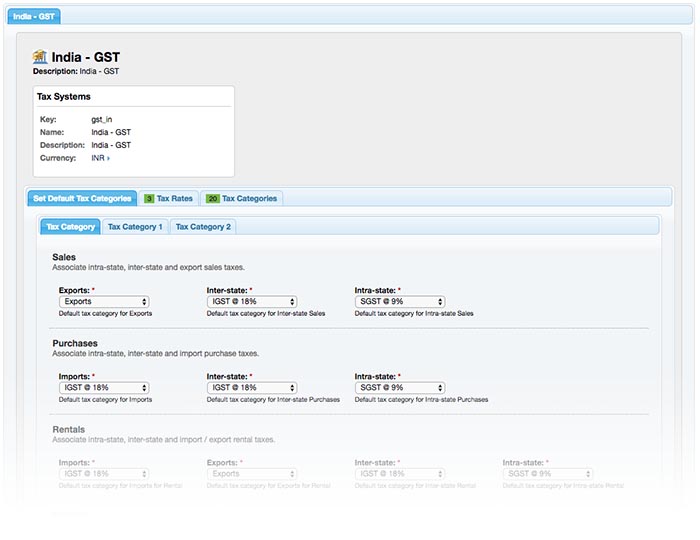

Webhuk supports multiple tax jurisdictions as add-on Modular Tax Systems. Based on the jurisdiction, a business can use one or more of these tax systems for their branches. The following tax systems come pre-installed with Webhuk, enabling structured invoicing and document generation for goods or services sold throughout the globe: India Goods and Service Tax (GST), UAE Value Added Tax (VAT), Ghana VAT, US Sales Tax and Flat-rate Tax Modules.

Multi-Branch / Multi-Tax Jurisdictions

Pre-programmed with the default tax rates under the India Goods and Service Tax (GST), UAE Value Added Tax (VAT), Ghana VAT and US Sales Tax Modules.

Separate categorization of tax rates by Intra-state, Inter-state, Exports and Imports.

Apply Tax on Shipment if applicable for your Business, configurable easily in Webhuk.

Support for HS code Stock Keeping Unit (SKU) categorization

Fine-tuned tax rates per SKU category, with a fallback to business-wide default tax rates.

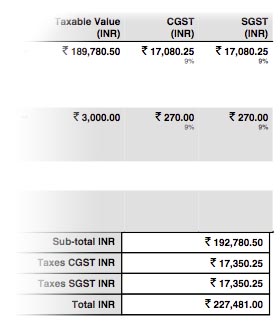

Input and Output Tax Credit reports for a real-time snapshot of GST liablilities.

Integrated with Double-Entry Book-keeping / Accounting.

Pass on Input Tax Credit on imported inventory where IGST has been paid, or roll-in landed price in other tax systems.

Preparation of GSTR-1 and GSTR-2 format invoices for uploading to the GSTN via your chosen GSP.